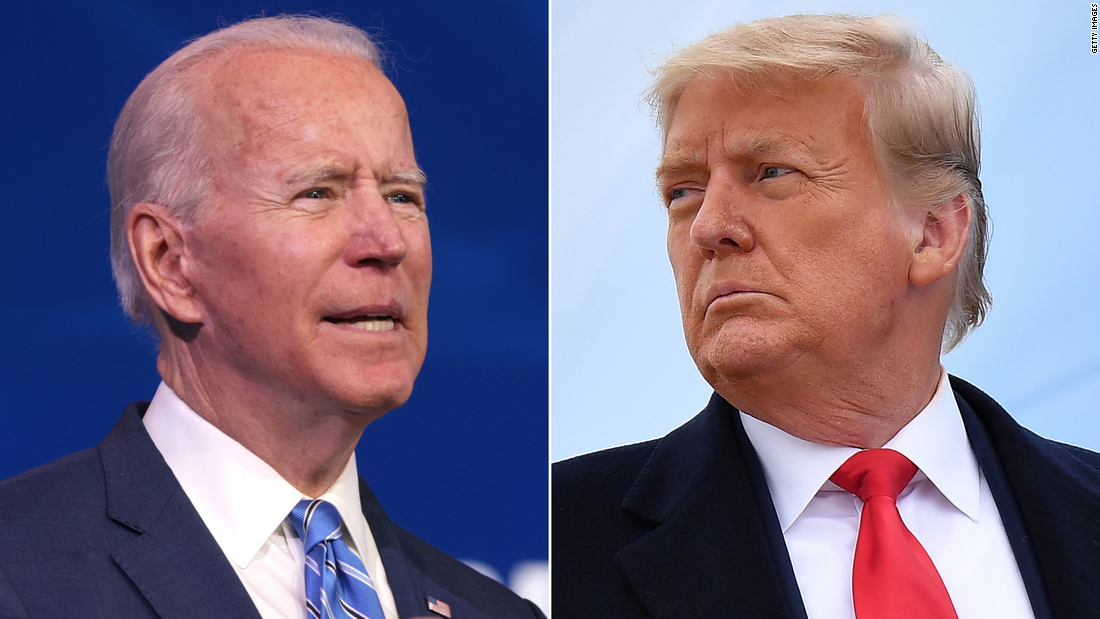

Pre-Sale Stocks: Trump hands Biden a thriving stock market

A look back: Stocks surged after Trump’s 2017 tax cuts boosted corporate profits, then tumbled at record speed as Covid-19 began hitting the United States. Since then, however, they have skyrocketed, repeatedly reaching all-time highs. The deep political polarization and a worsening epidemic were not enough to curb Wall Street.

Biden did not place as much emphasis as Trump on stocks as a measure of the country’s strength or well-being.

“The idea of a boom in the stock market is his only measure of what’s going on,” Biden said of Trump in the last presidential debate in October. “From where you come in Scranton and Clemont, people don’t live off the stock market.” (According to the most recent Gallup Poll, 55% of Americans have some exposure to the stock market, and many through retirement accounts.)

Nevertheless, Wall Street will be watching to see if the market momentum can be maintained. Chatter has increased in recent weeks that ratings of companies, particularly in the tech sector, have jumped quite significantly.

“Many investors are concerned that the stock market has recovered too much and too quickly, and that there are signs of a surplus emerging in parts of the financial system,” Peter Oppenheimer, chief global equities analyst at Goldman Sachs, told clients this week. “This is a reasonable concern given that the rebound in stocks since the market tumbled in March of last year has been noticeable.”

Oppenheimer said that although the correction – or a 10% drop in stocks from their last peak – appears “increasingly likely,” the odds of stocks entering a new bear market, 20% down from recent highs, next year seem reasonable. ” Low.”

He points to strong global economic growth projections in 2021 as the epidemic subsides, as well as “unprecedented” policy support.

On this front, however, there are still unknown people. While Federal Reserve Chairman Jerome Powell stressed that interest rates could remain at their historic lows for the foreseeable future, the fate of Biden’s $ 1.9 trillion stimulus package will depend on his ability to generate some Republican support. In divided Washington, this will not be an easy task.

Netflix is reaching the age of majority with 200 million subscribers

The latest: The streaming service notified investors on Tuesday that it now has more than 200 million subscribers globally, after adding 8.5 million in the fourth quarter of 2020 – exceeding its expectations.

This wasn’t the only indication that Netflix had developed into a mature player in Hollywood and on Wall Street.

The company also said that it will no longer need to borrow money to finance day-to-day operations, and that it will explore returning cash to shareholders through share buybacks.

Investor’s vision: Shares are up 13% in pre-market trading, pushing it to an all-time high on Wednesday.

Of course, competition in the broadcast market remains fierce. The company said Tuesday that ViacomCBS ‘newly renamed live streaming service, Paramount +, will start operating in early March – joining an increasingly crowded field that also includes Disney +, Apple TV +, Amazon Prime Video, Comcast’s Peacock, and AT&T’s. HBO Max and more.

But investors believe Netflix appears to be well positioned to keep its spot at the front of the pack. For example, UBS upgraded the company’s shares to a “buy” rating after it reported earnings, indicating continued strong global subscriber growth until [against] The increasing competition [and] Strong growth ‘in the first half of 2020.

Rich Greenfield of LightShed Partners noted on Twitter that while investors previously seemed concerned about how Netflix was financing its mega content production machine, the tone has changed.

The question now, he says, “What will you do with all the money you will start making in 2022 and beyond?”

Janet Yellen reviews Biden’s hard-line stance toward China

Janet Yellen, President-elect Joe Biden’s nominee to lead the Treasury Department, has made it clear that the incoming administration will maintain a tough approach to China – paving the way for protracted tensions between the world’s two largest economies.

“China undermines US companies by dumping products, erecting trade barriers, and giving subsidies to companies,” she said.

That position was echoed by Anthony Blinken, Biden’s nominee to lead the State Department, in his remarks on Tuesday before the Senate Foreign Relations Committee.

“President Trump was right to take a tougher approach to China,” Blinken said. “I strongly disagree with his approach to this in a number of areas, but the basic principle was correct.”

What it means: The battle between the US and China over trade and technology has been a major source of uncertainty for investors over the past four years. In the Biden era, this won’t end.

next one

Joe Biden will be sworn in as President of the United States at 12 noon EST.

Coming tomorrow: Economists are expecting another 910,000 first-time jobless claims claims, a sign of a weakening US labor market.

“Analist. Schepper. Zombiefanaat. Fervente reisjunkie. Popcultuurexpert. Alcoholfan.”