The Impact of Stimulus and Shifts in US Consumer Spending on the Trade Deficit

The one-way street of globalization by corporate America.

by Wolf Richter For Wolf Street.

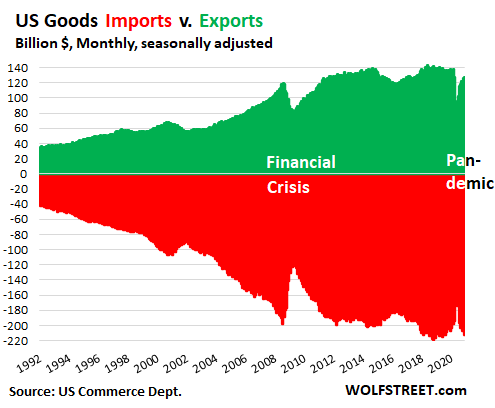

So this was inevitable, after the US stimulus efforts: The United States’ trade deficit in goods – exports minus imports of goods – hit a record in November of $ 84.8 billion, surpassing the previous record set in August, according to a prior estimate by US International. . Trade in goods before Department of Commerce. This advance estimate will likely be revised one way or the other with a whole bunch of trade data early next year.

During the financial crisis, the trade deficit narrowed drastically with declining imports because American consumers reduced their purchases of imported goods and goods, although they continued to purchase services, which were mostly not imported. Now the opposite happens: Consumers bought record quantities of durable goods, But cut back their spending on services. Many of the goods they bought were imported:

This is among the strange effects of the US effort to stimulate the economy through government grants to consumers and businesses, with the Fed’s grants of financial markets, and with the Federal Reserve curtailing interest rates. Trillions of dollars have been cut so fast that it’s hard to see.

These impacts have been increased by the epidemiological shift from purchasing services, such as flights, accommodations, and gym memberships, to items such as hot tubs on the deck for a vacation at home, laptops for learning at home, and bike trainers for exercising at home.

One of these effects is that the United States has stimulated the industrialization economies of China, Germany, Japan, Mexico and other countries in which these commodities are manufactured. But they, in turn, don’t buy enough American goods, for myriad reasons, including that the United States no longer manufactures many of these goods because American companies have globalized their supply chains and overseas production.

Goods imports jumped to $ 212 billion in November, according to the advance estimate by the Commerce Department today. This was still below the record set in October 2018 ($ 219 billion).

Goods exports rose to $ 127 billion but remained below 2018 levels which were themselves only a fraction of imports at the time. And the gap between imports and exports – the trade deficit in commodities – has continued to widen over the years:

The value of imports is negative in the GDP accounts. The value of exports is considered positive in GDP calculations – hence the colors in the chart above, green or exports and red for imports.

The American consumer economy was driven by the relentless globalization of American companies and their ambitions to manufacture the last piece of goods in other countries, especially the cheap ones. The US tax system also encourages them to do so.

In terms of retailers, Walmart has been one of the leaders for decades. But now, they all do it. E-commerce makes it easier. Amazon has mastered it; On its platform, Americans can buy directly from Chinese and Indian manufacturers.

Corporate America sells a lot of goods in other countries. For example, all of the US automakers are large in China. General Motors and its joint ventures are the premier automaker in China. But these compounds are manufactured in China, and now some are being imported into the United States.

Tesla does the same. on him They got 1.6 billion dollars in funding from government agencies in China To set up a factory and design center in China. The 3s you are selling in China, and soon the Model Y was made in China. It is doing the same now in Germany for its European sales.

The majority of Apple’s revenue comes from markets outside the United States, and overseas manufactures most of its products that it sells there.

US consumer goods companies, automakers, and many other manufacturers have largely abandoned manufacturing and exporting their products in the United States. Globalization has become a one-way street.

American companies are powerhouses overseas, but they have moved more and more production from the United States to other countries. This is why the boom in US branded consumer goods sold overseas does not boost US exports and manufacturing. But the boom in US commodity sales, like the now deficit-financed stimulus boom, boosts US imports. Thanks to the one-way street of globalization.

Consumers earned more in November than in the good times, but far less than they did when the free money to fight the pandemic was growing exponentially. Read… The majestic overrun of the stimulus money is over. Faced with the second wave, Americans cut back, even on durable goods

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally understand why – but want to support the site? You can donate. I appreciate it very much. Click on a beer mug and iced tea to see how:

Would you like to be notified via email when WOLF STREET publishes a new article? Register here.

![]()