NYSE scraps plan to write off shares of Chinese telecom giants

Photographer: Michael Nagel / Bloomberg

Photographer: Michael Nagel / Bloomberg

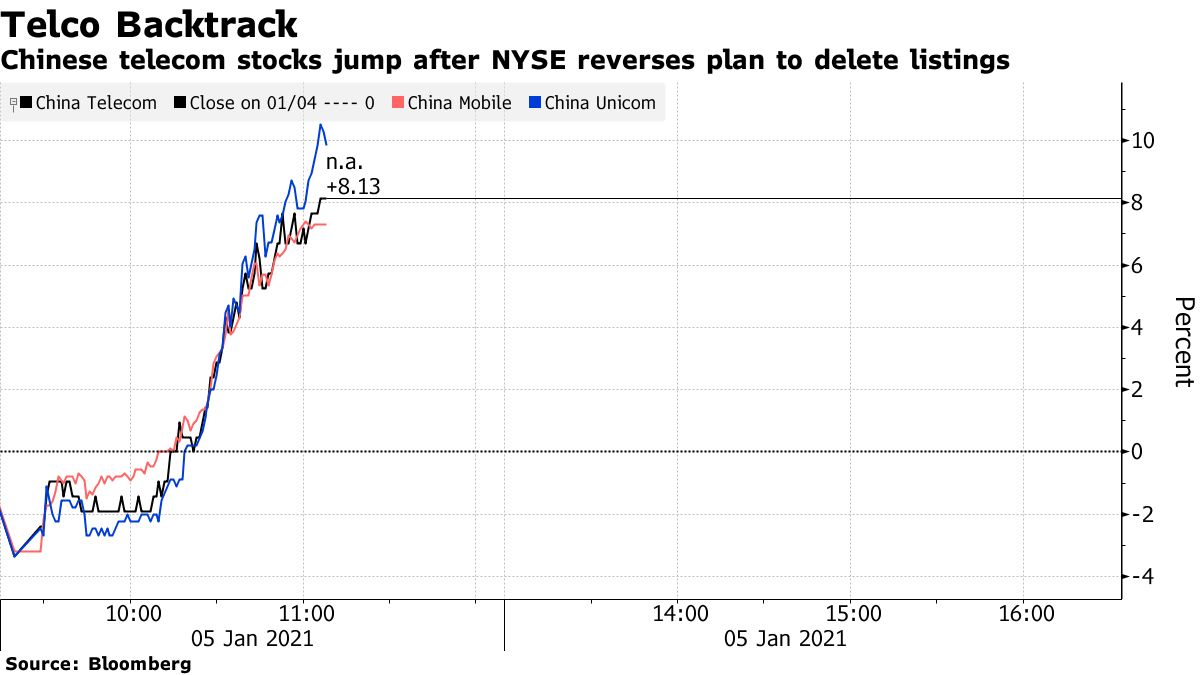

The The New York Stock Exchange said it would no longer write off the three largest state-owned telecom companies in China, backing away from a plan that threatened to escalate tensions between the world’s largest economies.

The turnaround on the New York Stock Exchange came just four days after the exchange announced that it would remove China Mobile Ltd. shares. China Telecom Corp. and China Unicom Hong Kong Ltd. to comply with a US executive order. The New York Stock Exchange cited “consultation with relevant regulatory authorities” in a brief statement late Monday declaring otherwise.

stocks China Mobile, China Telecom and Unicom rallied on the latest development, rising more than 6% in Hong Kong’s trade. The calls and emails were not returned to the companies immediately on Tuesday.

On New Year’s Eve, the New York Stock Exchange said it would remove companies from the list in compliance with an order issued by US President Donald Trump in November banning US investments in Chinese companies owned or controlled by the military. It was the first time that a US stock exchange had announced plans to remove a Chinese company as a direct result of escalating geopolitical tensions between the two superpowers.

The move to write off shares increased concerns about mutual sanctions on Chinese and US companies. The former has turned to the US stock market for capital and international standing for more than two decades, raising at least $ 144 billion from some of the world’s largest investors. Wall Street banks are particularly keen to see a reduction in tensions after gaining an unprecedented scope to operate in China last year.

(Updates with background)